时间:2019年07月22日(星期一)上午09:30-11:30;下午2:30-4:30

地点:买球赛的app官网722

报告题目:

Trademarks in Entrepreneurial Finance

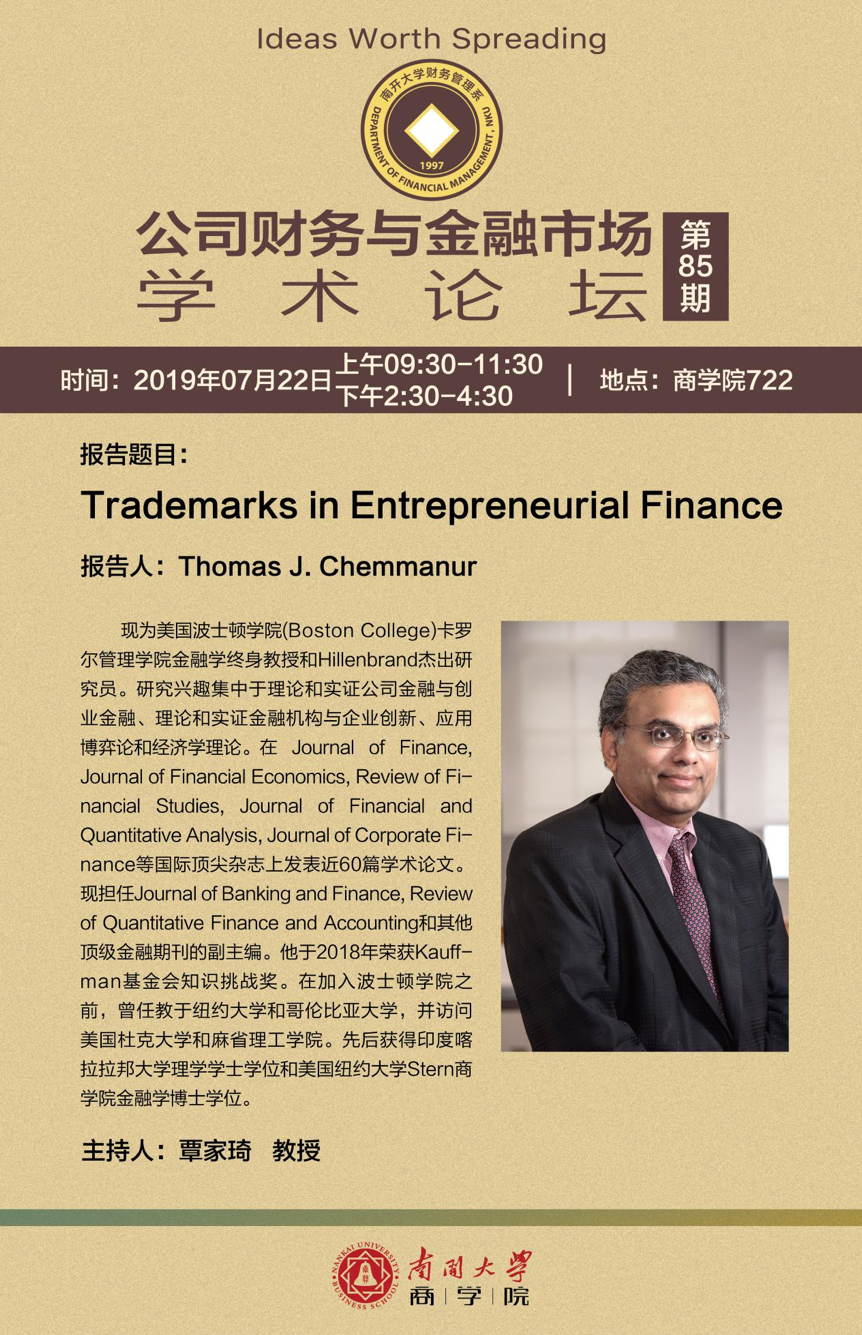

报告人:Thomas J. Chemmanur

现为美国波士顿学院(Boston College)卡罗尔管理学院金融学终身教授和Hillenbrand杰出研究员。研究兴趣集中于理论和实证公司金融与创业金融、理论和实证金融机构与企业创新、应用博弈论和经济学理论。在 Journal of Finance, Journal of Financial Economics, Review of Financial Studies, Journal of Financial and Quantitative Analysis, Journal of Corporate Finance等国际顶尖杂志上发表近60篇学术论文。现担任Journal of Banking and Finance, Review of Quantitative Finance and Accounting和其他顶级金融期刊的副主编。他于2018年荣获Kauffman基金会知识挑战奖。在加入波士顿学院之前,曾任教于纽约大学和哥伦比亚大学,并访问美国杜克大学和麻省理工学院。先后获得印度喀拉拉邦大学理学学士学位和美国纽约大学Stern商学院金融学博士学位。

主持人:覃家琦 教授

主办方:财务管理系

论文摘要:

We analyze the role of trademarks in entrepreneurial finance, hypothesizing that trademarks play two economically important roles: a protective role, leading to better product market performance; and an informational role, signaling higher firm quality to investors. We develop testable hypotheses based on the above two roles of trademarks, relating the trademarks held by private firms to the characteristics of venture capital (VC) investment in them, their probability of successful exit, their valuations at their initial public offffering (IPO) and in the immediate secondary market; institutional investor IPO participation; post-IPO information asymmetry; and post-IPO operating performance. We test these hypotheses using a large and unique dataset of trademarks held by VC-backed private fifirms. We establish causality using an instrumental variable (IV) analysis using trademark examiner leniency as the instrument. For private firms, we find that the number of trademarks held by the firm is positively related to the total amount invested by VCs and negatively related to the extent of staging by VCs. We show that the number of trademarks held by a firm increases its probability of successful exit (IPOs or acquisitions). Further, for the subsample of VC-backed firms going public, we show that the number of trademarks held by the firm leads to higher IPO and immediate secondary market fifirm valuations; greater IPO participation by institutional investors; a lower extent of information asymmetry in the equity market post-IPO; and better post-IPO operating performance.